In today’s fast-evolving digital economy, businesses must adapt to remain competitive. One major shift taking place globally is the adoption of e-invoicing—a digital alternative to traditional paper-based invoicing. In Malaysia, this shift is gaining momentum due to regulatory changes, efficiency benefits, and global best practices. This article explores the current e-invoicing landscape, key trends shaping its future, and why businesses—big and small—should embrace this transformation now.

Table of Contents

ToggleThe Rise of E-Invoicing in Malaysia

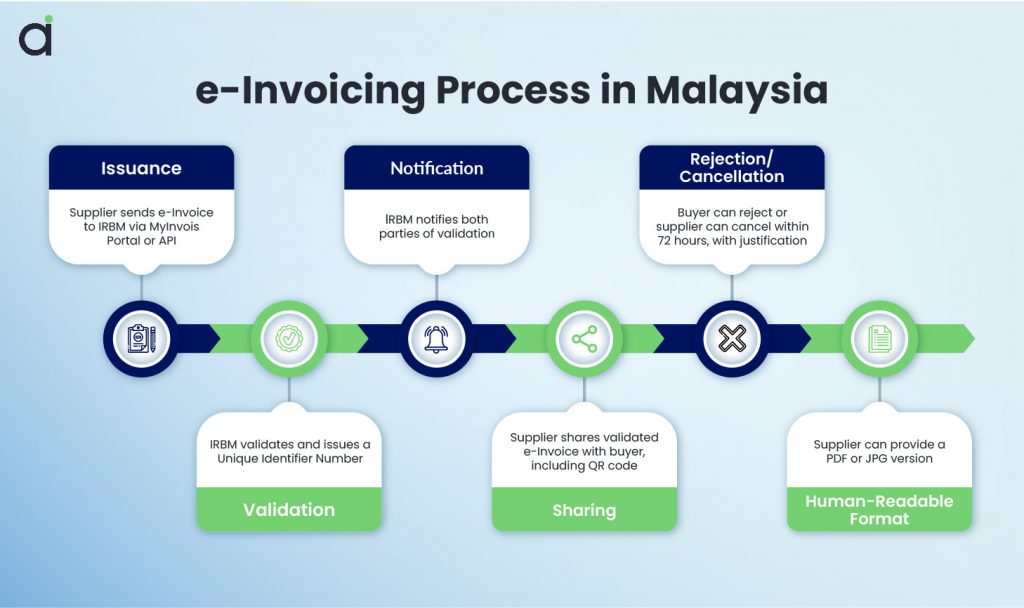

The Malaysian government, through the Inland Revenue Board of Malaysia (LHDN), has introduced e-invoicing as part of its broader digital tax initiatives. This move aligns with global trends where governments are pushing for greater transparency, efficiency, and automation in tax reporting. With Malaysia set to mandate e-invoicing by 2024, businesses must prepare to integrate digital invoicing solutions seamlessly.

What is E-Invoicing?

E-invoicing refers to the digital exchange of invoices between businesses using a standardized electronic format. Unlike PDFs or scanned documents, true e-invoicing allows seamless integration with accounting systems, tax authorities, and payment gateways, ensuring compliance and automation.

Key E-Invoicing Trends Shaping Malaysia’s Digital Economy

1. Government-Led Digital Initiatives

Countries worldwide are mandating e-invoicing to curb tax evasion and enhance financial transparency. In Malaysia, LHDN’s e-invoicing initiative follows the footsteps of nations like Singapore, Italy, and India, where digital tax reporting has improved compliance and reduced fraud.

2. Increased Adoption Among SMEs and Solopreneurs

While large enterprises may find it easier to transition, the Malaysian government is encouraging SMEs and freelancers to adopt e-invoicing early. Solutions like Assist.biz simplify this process, ensuring compliance without the complexity of enterprise-level software.

3. Cloud-Based and AI-Driven Automation

E-invoicing platforms are leveraging cloud technology and artificial intelligence (AI) to enhance automation. Features like auto-reconciliation, real-time tax calculations, and fraud detection are becoming standard, making invoicing more efficient and error-free.

4. Integration with E-Commerce and Payment Gateways

With the boom in e-commerce and digital payments, e-invoicing solutions are increasingly integrating with platforms like GrabPay, PayPal, and FPX. This ensures smoother transactions, automated reconciliation, and improved cash flow management for businesses.

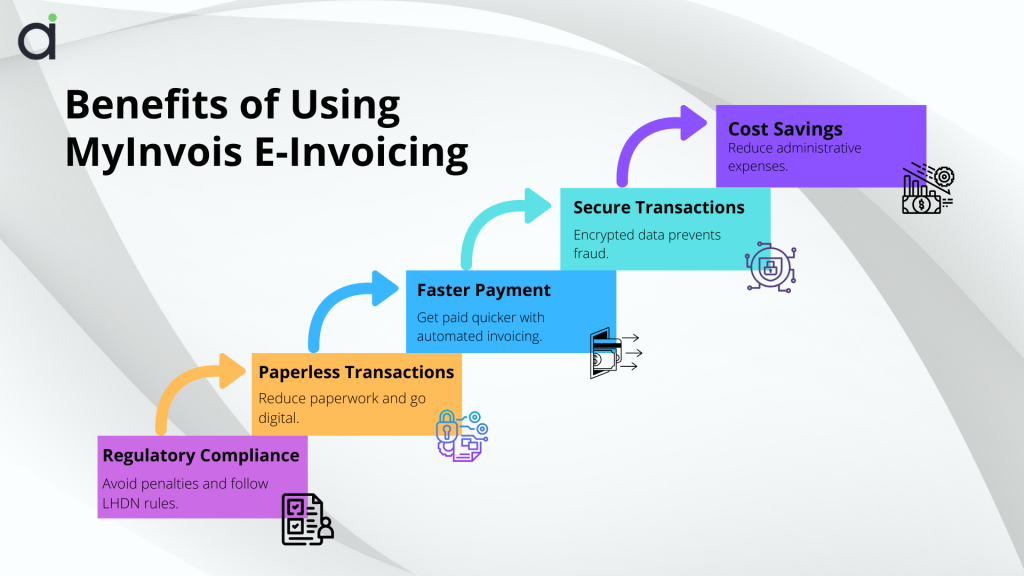

5. Sustainability and Cost Reduction

Beyond compliance, e-invoicing reduces operational costs by eliminating paper, printing, and manual processing. It also supports sustainability goals by significantly cutting down on carbon footprints—something increasingly valued by eco-conscious consumers and businesses.

Benefits of E-Invoicing for Businesses

Whether you’re a solopreneur, SME, or large corporation, e-invoicing offers substantial advantages:

Faster Payments: Automating invoice processing reduces delays, ensuring timely payments.

Error Reduction: Digital invoices minimize manual entry mistakes, reducing disputes.

Regulatory Compliance: Stay ahead of tax regulations with automated tax reporting.

Improved Cash Flow: Real-time tracking helps businesses manage finances more effectively.

Better Security: Encrypted, tamper-proof invoices safeguard against fraud.

Common Mistakes Businesses Make When Transitioning to E-Invoicing

- Delaying Implementation: Waiting until the last minute can lead to compliance issues and rushed implementations.

- Choosing the Wrong Platform: Not all e-invoicing solutions are equal—select a system that ensures compliance and seamless integration.

- Lack of Employee Training: Teams must understand how to use e-invoicing tools effectively to maximize benefits.

- Not Leveraging Automation: Failing to utilize AI-driven features can result in lost efficiency gains.

The Time to Act is Now: Embrace E-Invoicing with Assist.biz

The transition to e-invoicing in Malaysia isn’t a question of “if” but “when.” With regulatory deadlines approaching, businesses that adopt e-invoicing early will gain a competitive edge, ensure compliance, and streamline operations.

Assist.biz provides an easy-to-use, LHDN-compliant e-invoicing solution designed for Malaysian businesses of all sizes. Whether you’re a freelancer, SME, or enterprise, we help you navigate the shift effortlessly.

Don’t wait until the deadline—future-proof your business today! Sign up with Assist.biz and start your e-invoicing journey hassle-free!

Frequently Asked Questions (FAQ)

What is digital invoicing, and how is it different from traditional invoicing?

Digital invoicing, or e-invoicing, is the electronic generation, transmission, and storage of invoices using a standardized format. Unlike traditional paper or PDF invoices, digital invoices integrate with accounting systems and tax authorities for automation, compliance, and faster processing.

Is e-invoicing mandatory in Malaysia?

Yes, Malaysia’s Inland Revenue Board (LHDN) is implementing mandatory e-invoicing as part of its digital tax initiative. Businesses should prepare for compliance by adopting e-invoicing solutions before the enforcement deadline.

How does digital invoicing benefit SMEs and freelancers?

E-invoicing streamlines operations, reduces manual errors, ensures tax compliance, speeds up payments, and minimizes costs. For SMEs and freelancers, this means improved cash flow and less administrative hassle.

What are the penalties for non-compliance with e-invoicing regulations?

While exact penalties depend on LHDN’s enforcement policies, businesses failing to comply may face fines, audits, or tax-related complications. Adopting a compliant solution like Assist.biz helps avoid these risks.

What features should I look for in an e-invoicing solution?

An ideal e-invoicing system should offer:

- LHDN compliance

- Automated tax calculations

- Integration with accounting and payment systems

- Secure, encrypted invoice storage

- Real-time tracking and reporting

How do I transition my business to e-invoicing?

Start by choosing an LHDN-compliant e-invoicing provider like Assist.biz, train your team, integrate the system with your accounting tools, and automate invoicing processes for seamless compliance.