Singapore E-Invoicing Submission: Debunking the Same Day Submission Myth for 2026

In Singapore, there is no legal requirement to submit...

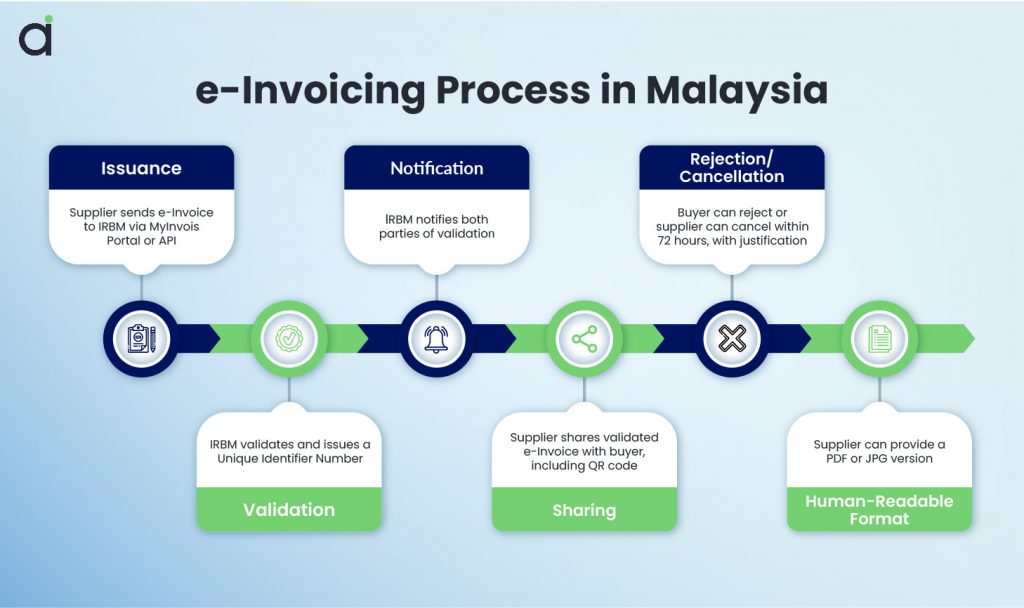

Digital transformation has emerged as a primary focus of Malaysia’s financial sector. E–invoicing (electronic invoicing), in which paper-based invoicing is replaced with a digital alternative, is at the heart of this transformation. This change is in line with Malaysia’s larger digital economy objectives and makes financial activities easier.

In this article, we explore how e-Invoicing is driving digital transformation in Malaysia, its benefits, compliance requirements, and how businesses can adapt to this change.

Table of Contents

ToggleAn e-Invoice is a digital version of an invoice, credit note, or debit note, ensuring seamless transactions between suppliers and buyers. It contains all essential details, such as:

Supplier and buyer information

Item descriptions, quantities, and pricing

Taxes and total payable amount

Unlike PDFs or scanned copies, a true e-Invoice is structured and standardized, enabling real-time validation and automation.

The Inland Revenue Board of Malaysia (IRBM) has introduced a phased implementation plan for mandatory e-Invoicing:

📌 Phase 1: August 1, 2024 – Businesses with annual turnover above RM100 million must comply.

📌 Phase 2: January 1, 2025 – Businesses with annual turnover between RM25 million and RM100 million must comply.

📌 Phase 3: July 1, 2025 – Businesses with annual turnover between RM500,000 and RM25 million must comply.

📌 Phase 4: January 1, 2026 – Businesses with annual turnover between RM150,000 and RM500,000 must comply.

This initiative aims to enhance efficiency, reduce manual efforts, and minimize errors associated with traditional invoicing methods.

E-Invoicing is a fundamental component of digitization in finance and provides a number of benefits:

✅ Operational Efficiency: Automation reduces manual data entry, improving accuracy and transaction speed.

✅ Cost Savings: Eliminates expenses related to printing, storing, and mailing invoices.

✅ Regulatory Compliance: Ensures tax accuracy, real-time validation, and minimizes penalties.

✅ Improved Cash Flow: Faster invoice processing leads to quicker payments and better liquidity.

✅ Data Accuracy: Digital records reduce discrepancies and enhance financial reporting.

Implementing e-Invoicing requires careful planning and consideration of several technical aspects:

📌 System Integration: Ensure seamless connectivity between your accounting software or ERP system and the IRBM’s MyInvois Portal using APIs.

📌 Data Security: Protect financial data with strong cybersecurity measures to prevent breaches.

📌 User Training: Train employees to adopt digital workflows and maximize efficiency.

While the benefits are substantial, businesses may encounter challenges during the transition:

Challenge: SMEs may lack the necessary infrastructure for e-Invoicing.

Solution: Cloud-based solutions like Assist.biz provide easy integration and ensure compliance.

Challenge: Employees may resist transitioning from manual invoicing.

Solution: Provide training sessions and highlight efficiency benefits to encourage adoption.

Challenge: Implementing e-Invoicing requires upfront costs.

Solution: Long-term savings from automation and compliance outweigh initial expenses.

Adapting to e-Invoicing doesn’t have to be complex. Assist.biz offers user-friendly e-Invoicing solutions that integrate seamlessly with the IRBM’s MyInvois system, ensuring compliance and efficiency for businesses in Malaysia.

✔ IRBM-Compliant E-Invoicing Solutions

✔ Easy Integration with Accounting & ERP Systems

✔ Automated Invoice Processing & Real-Time Validation

✔ Secure & Reliable Cloud-Based Platform

E-Invoicing is more than a regulatory requirement—it is a key driver of digital transformation in Malaysia’s finance sector. Businesses that adopt e-Invoicing early can benefit from greater efficiency, compliance, and financial accuracy.

By choosing a trusted e-Invoicing provider like Assist.biz, businesses can ensure a smooth transition while leveraging digital tools to stay competitive.

🔹 Don’t wait! Future-proof your invoicing process with Assist.biz today.

The E-Invoicing is the digital process of creating, sending, and receiving invoices electronically. It eliminates manual invoicing, reduces errors, and ensures tax compliance.

Yes, Malaysia is implementing mandatory e-Invoicing in phases based on annual turnover. Businesses with a turnover above RM150,000 must comply by 2026, while smaller businesses are encouraged to adopt it voluntarily.

For Businesses, E-Invoicing improves efficiency, compliance, and cash flow while reducing costs, errors, and paperwork. It also ensures real-time validation through IRBM’s MyInvois platform.

Businesses must integrate their accounting or ERP systems with IRBM’s MyInvois portal or use a compliant e-Invoicing provider like Assist.biz for seamless compliance.

The IRBM has introduced a six-month grace period for each phase, allowing businesses to adapt without penalties. However, non-compliance beyond this period could result in fines or audits.

To comply, businesses can either directly integrate with the IRBM MyInvois system or use a trusted e-Invoicing provider like Assist.biz to simplify the process.

In Singapore, there is no legal requirement to submit...

To prepare for Singapore’s e-invoice implementation, taxpayers must align with...

Pelaksanaan Invois Kendiri di Singapura memberi kuasa kepada pembeli untuk...

In essence, the issuance of a self-billed invoice in...