Invoicing is a crucial part of any business, ensuring smooth transactions and proper record-keeping. Traditionally, businesses relied on paper invoices or manual processes. However, with digital transformation, e-invoicing has emerged as a faster, more efficient, and cost-effective alternative. But is it the right choice for your business? In this article, we’ll compare e-invoicing vs. traditional invoicing, analyze their pros and cons, and help you determine which invoicing system aligns best with your business needs.

Table of Contents

ToggleWhy Invoicing Matters

Invoicing plays a crucial role in every business. After all, invoices are the official records of your transactions. As a result, they help businesses track payments, manage cash flow, and ensure compliance with tax regulations. Additionally, a well-managed invoicing system can significantly improve business efficiency. Therefore, optimizing your invoicing process becomes essential as your business grows and the volume of invoices increases.

What Is Traditional Invoicing?

Traditional invoicing refers to the manual process of creating, sending, and managing invoices. It often involves:

- Physical invoices (printed copies, handwritten invoices, or PDF invoices sent via email)

- Manual data entry into accounting systems

- Postal or courier delivery of invoices to clients

- Longer processing times due to delays in delivery, approval, and payment

- Risk of human errors, such as incorrect billing details or duplicate invoices

What Is E-Invoicing?

On the other hand, e-invoicing (electronic invoicing) is a digital solution for generating, sending, and processing invoices electronically. It integrates seamlessly with accounting software, government tax portals, and ERP systems. Thus, it offers a faster and more secure way to handle invoices.

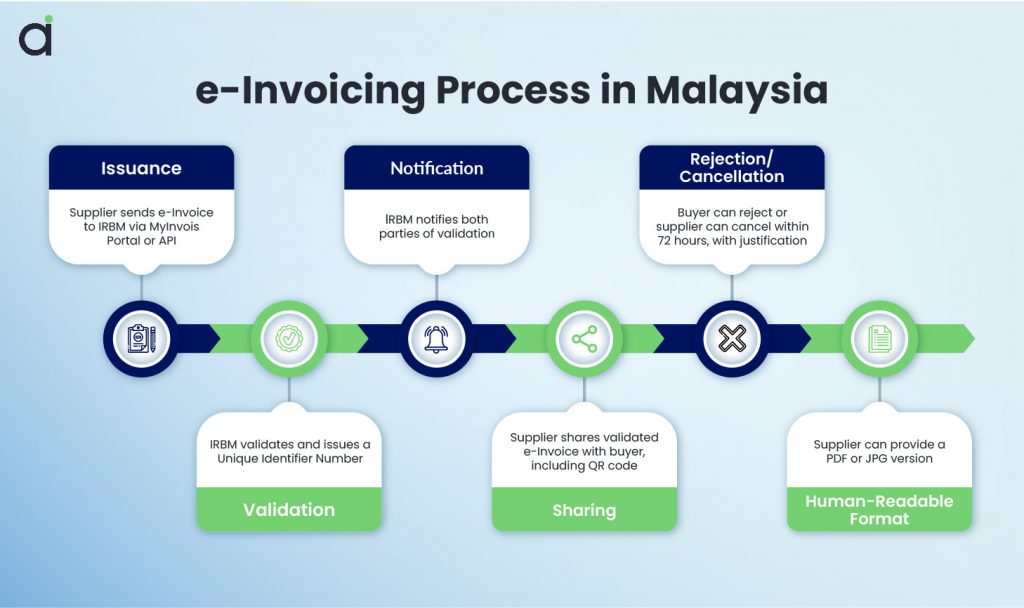

How E-Invoicing Works

- Invoice Creation – Automatically generated using e-invoicing software.

- Data Validation – The system checks for compliance and errors.

- Invoice Submission – Sent electronically through an integrated platform.

- Approval & Payment – Fast processing with quick approvals and payments.

- Automated Record-Keeping – Digital storage for easy access and compliance.

In contrast to traditional invoicing, e-invoicing provides a more streamlined process that enhances overall business efficiency.

Pros & Cons of Traditional Invoicing

✅ Familiar and widely accepted

✅ No need for technical infrastructure

✅ Personal touch in certain industries

❌ Time-consuming due to manual processes

❌ High costs (printing, postage, storage)

❌ Increased risk of errors (misplaced invoices, incorrect details)

❌ Slower payment processing, leading to cash flow issues

❌ Limited tracking and reporting capabilities

Pros & Cons of E-Invoicing

✅ Faster processing and payments

✅ Reduced administrative costs and human errors

✅ Compliance with government regulations (LHDN E-Invoice in Malaysia)

✅ Better security and fraud prevention

✅ Real-time tracking and reporting for better financial management

✅ Improved cash flow with quicker invoice approvals and payments

❌ Requires initial setup and integration with software

❌ May require staff training to adapt to digital invoicing systems

❌ Dependent on internet connectivity and digital literacy

Real-World Examples of E-Invoicing Benefits

For example, small business owners can greatly benefit from the efficiency of e-invoicing, allowing them to save time on manual data entry and focus more on growing their business. Furthermore, large enterprises can automate invoicing processes to handle high volumes of transactions while reducing the risk of errors and improving tax compliance. In addition, as many governments, including Malaysia, are mandating e-invoicing for tax reporting, businesses need to comply to avoid penalties and ensure smooth operations.

| Feature | Traditional Invoicing | E-Invoicing |

|---|---|---|

| Processing Time | Slow (manual handling) | Fast (automated processing) |

| Cost | High (printing, postage, storage) | Low (paperless, automated) |

| Error Risk | High (manual data entry mistakes) | Low (automation reduces errors) |

| Payment Speed | Delayed (longer approval process) | Faster (real-time transactions) |

| Compliance | Manual tax reporting | Automated tax compliance (e.g., MyInvois) |

| Security | Risk of lost invoices or fraud | Secure digital records with encryption |

| Scalability | Difficult to scale | Easily scalable for growing businesses |

| Tracking & Reporting | Limited | Real-time insights & audit trails |

Governments worldwide, including Malaysia, are making e-invoicing vs traditional invoicing a mandatory transition for tax reporting. This makes e-invoicing the future of business invoicing.

Which One Should You Choose?

Choose Traditional Invoicing If:

✅ Your business handles a low volume of invoices per month

✅ You prefer manual control over invoicing and bookkeeping

✅ Your clients or industry still require paper invoices

✅ You operate in a region with low digital infrastructure

Choose E-Invoicing If:

✅ You want to automate and streamline your invoicing process

✅ You need faster payment cycles and improved cash flow

✅ Your business deals with high invoice volumes

✅ You want to stay compliant with Malaysia’s MyInvois and LHDN regulations

✅ You aim to reduce costs and administrative work

✅ You need real-time reporting for better financial insights

Need Help Getting Started with E-Invoicing?

If you’re considering adopting e-invoicing in Malaysia, check out Assist e-Invoice for a seamless and compliant solution!

Assist: Your LHDN-Compliant e-Invoice Solution for Seamless Efficiency

- LHDN-Compliant: Assist ensures your e-invoices meet all Lembaga Hasil Dalam Negeri (LHDN) requirements, minimizing compliance risks.

- Seamless Integration: Assist integrates smoothly with your existing systems, simplifying the transition to e-invoicing.

- User-Friendly Interface: Assist offers an intuitive platform, making e-invoice creation and management easy for your team.

- Enhanced Efficiency: Automate your invoicing processes with Assist, saving time and resources.

- Secure and Reliable: Assist provides a secure platform for handling your sensitive financial data.

- Comprehensive Solution: From invoice generation to submission, Assist offers a complete e-invoicing solution.

- Dedicated Support: Assist provides excellent customer support to help you with any questions or issues.

Software | Compliance | Automation Features | Integrations | Pricing & Target Audience |

Assist | LHDN Compliant | Automated Data Entry, Duplicate Detection | Xero, QuickBooks, MyInvois | Free (30 pages), RM 8 (50 pages), RM 16 (1000 pages) – SMEs, Small Businesses |

Axrail | LHDN Compliant | Automated Invoicing | ERP, Accounting Systems | Contact for pricing – Enterprises, Large Businesses |

Taxilla | LHDN Compliant | Automated Invoice Processes | ERP, Accounting Systems | Contact for pricing – Enterprises, Large Businesses |

IFCA | LHDN, MDEC | Automated Workflows | ERP, POS | Contact for pricing – Enterprises, Large Businesses |

Million | MY E-Invoicing | Accounting Modules | MyInvois | RM 1,499+ (Coding License), RM 1,899+ (Dongle License) – Businesses of all sizes |

Autocountsoft | MyInvois | Generation, Submission, Processing | MyInvois | Contact for pricing – Enterprises, Large Businesses |

GSTHero | MY E-Invoicing | Automation of Key Tasks | Popular Software | Contact for pricing – Enterprises, Large Businesses |

Webtel | MY E-Invoicing | Automated Invoicing | ERP, Accounting Systems | Contact for pricing – Enterprises, Large Businesses |

BinarySemantics | MY E-Invoicing | Automated Invoice Processing | ERP, Accounting Systems, Peppol | Contact for pricing – Enterprises, Large Businesses |

ClearTax | MY E-Invoicing | Automated Invoicing | Various ERPs | Contact for pricing – Enterprises, Large Businesses |

Zetpy | Not Specified | Inventory, Order Processing, Accounting | Xero, QuickBooks, Autocount, WooCommerce, Magento | Free (100 orders), RM 150 (Basic), RM 300 (Pro), RM 3,000+ (Enterprise) – Businesses, E-commerce |

Pagero | Global | Automated Invoice Processing | Various ERPs, Accounting Systems | Contact for pricing – Enterprises, Large Businesses |

Basware | Global | AI-Powered Automation | 250+ ERPs | Contact for pricing – Enterprises, Large Businesses |

Conclusion

The shift toward e-invoicing vs traditional invoicing is not just a trend—it’s becoming a necessity for businesses that want to stay competitive, compliant, and efficient. If your business is ready to take the next step, Assist e-Invoice provides a user-friendly, reliable, and fully compliant solution to help you navigate the future of invoicing.

FAQ about Einvoice vs traditional invoice

What is the main difference between e-invoicing and traditional invoicing?

Traditional invoicing relies on manual processes and paper or PDF documents, while e-invoicing uses digital data exchange between systems, automating creation, sending, and processing.

How does e-invoicing help with tax compliance ?

E-invoicing facilitates automated tax reporting, reducing the risk of errors and ensuring compliance with regulations like MyInvois and LHDN requirements.

How do I implement e-invoicing in my business?

Implementing e-invoicing involves choosing e-invoicing software, integrating it with existing accounting or ERP systems, training staff, and communicating the change to clients.

Is e-invoicing more expensive than traditional invoicing?

While there might be initial setup costs, e-invoicing generally reduces long-term costs associated with printing, postage, storage, and manual processing.

What is MyInvois, and how does it relate to e-invoicing in Malaysia?

MyInvois is the name of the Malaysian government’s e-invoicing system or initiative. It signifies the country’s push towards mandatory e-invoicing for tax purposes.