Big news for businesses in Malaysia—mandatory e-Invoicing has been pushed back by six months! Originally set to take effect on July 1, 2025, following the Malaysia E-Invoicing 2026 timeline, the new deadline is now January 1, 2026. This extension gives businesses, especially small and medium enterprises (SMEs), more time to prepare for the transition.

Table of Contents

ToggleWhat Is E-Invoicing?

E-Invoicing is a fully digital way to create, send, and store invoices—eliminating the need for paper-based billing. It’s designed to streamline operations, reduce errors, and ensure compliance with tax regulations. The Malaysian government is rolling it out to improve efficiency, prevent tax fraud, and align with global digitalization trends.

Revised E-Invoicing Timeline

The implementation of e-Invoicing in Malaysia is structured in multiple phases based on annual business turnover:

August 1, 2024 – Businesses with an annual turnover exceeding RM100 million must comply.

January 1, 2025 – Businesses with an annual turnover between RM25 million and RM100 million must adopt the system.

July 1, 2025 – Businesses earning between RM500,000 and RM25 million annually are required to implement e-Invoicing.

January 1, 2026 – The final group, businesses with annual revenue between RM150,000 and RM500,000, must comply.

💡 Businesses generating less than RM150,000 annually are currently exempt from mandatory e-Invoicing requirements.

Why Was the Malaysia E-Invoicing 2026 Deadline Extended?

Switching to e-Invoicing requires financial investment, system upgrades, and staff training—challenges that many businesses, especially SMEs, face. The six-month extension gives them extra time to prepare and adapt without disrupting operations.

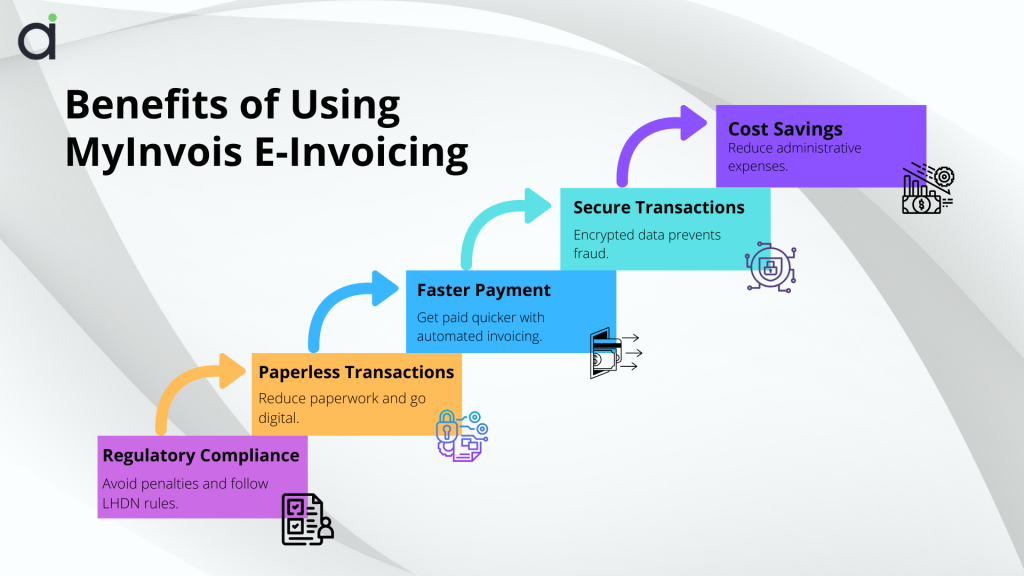

Benefits of E-Invoicing for Businesses

Aside from compliance, adopting e-Invoicing comes with major advantages:

✅ Increased Efficiency – Automates invoicing, reducing manual work and errors.

✅ Cost Savings – Eliminates paper invoices, printing, and postage costs.

✅ Better Compliance – Ensures tax accuracy and reduces audit risks.

✅ Faster Payments – Digital invoices speed up payment processing and cash flow.

Interim Measures to Ease the Transition

To help businesses adapt, the government has introduced temporary measures:

- Businesses can issue consolidated e-Invoices instead of individual ones.

- Self-billed e-Invoices are permitted for specific transactions.

- Greater flexibility in describing products and services.

- Customers don’t need separate e-Invoices if a consolidated version is available.

These steps aim to lighten the burden for businesses while they integrate e-Invoicing into their workflows.

Government Support and Incentives

To encourage businesses to comply, the Malaysian government has introduced various support initiatives:

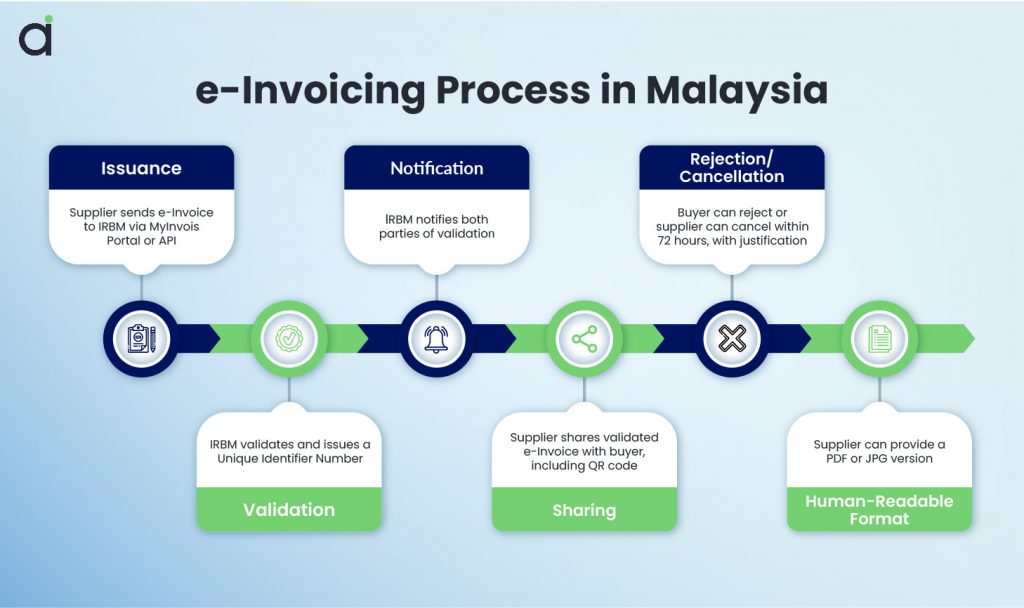

💻 MyInvois Portal – A free online platform to generate e-Invoices without extra software.

📱 MyInvois Mobile App – Businesses can manage invoices on the go.

💰 Tax Deductions – Businesses can claim up to RM50,000 annually (2024–2027) for e-Invoicing-related expenses.

These initiatives reduce compliance costs and make it easier for businesses to transition.

How Businesses Should Prepare for Malaysia E-Invoicing 2026

Even with the deadline extension, businesses should start preparing now to avoid last-minute issues. Here’s how:

1️⃣ Review Your Current Invoicing System – Can it integrate with e-Invoicing?

2️⃣ Upgrade If Needed – Invest in compatible software and digital tools.

3️⃣ Train Your Team – Ensure employees understand how to use e-Invoicing.

4️⃣ Seek Professional Advice – Consult tax experts for guidance.

5️⃣ Test Before the Deadline – Implement e-Invoicing early to troubleshoot potential issues.

Final Thoughts

By extending the deadline to January 2026, the Malaysian government is giving businesses a valuable opportunity to prepare properly. Use this time wisely—getting ahead now will save you stress later. And in the long run, e-Invoicing will make invoicing faster, cheaper, and more efficient.

💼 Upgrade to Hassle-Free Invoicing with Assist E-Invoice Software!

Tired of invoice delays, tax complications, and manual errors? Assist E-Invoice Software makes invoicing effortless, accurate, and fully compliant—so you can focus on growing your business!

🔹 Why Choose Assist?

✔️ Automated & Error-Free – Say goodbye to manual data entry.

✔️ Real-Time Tax Compliance – Stay ahead of regulations with ease.

✔️ Faster Payments – Get paid quicker with seamless digital transactions.

✔️ Affordable & Cost-Effective – Premium features without the premium price!

💡 Say goodbye to delays and hello to efficiency!

Frequently Asked Questions (FAQ)

What is e-Invoicing in Malaysia?

E-Invoicing is an electronic method of generating, sending, and storing invoices, replacing paper-based invoicing to improve efficiency and tax compliance.

Why was the e-Invoicing deadline extended to January 2026?

The deadline was extended by six months to allow businesses, especially SMEs, more time to prepare for the transition, upgrade systems, and train staff.

Which businesses must comply with e-Invoicing in Malaysia?

Businesses with an annual turnover above RM150,000 must implement e-Invoicing, with a phased rollout from 2024 to 2026 based on revenue brackets.

Are businesses earning less than RM150,000 required to use e-Invoicing?

No, businesses with an annual revenue below RM150,000 are currently exempt from mandatory e-Invoicing requirements.

What are the benefits of e-Invoicing for businesses?

E-Invoicing enhances efficiency, reduces costs, ensures tax compliance, speeds up payment cycles, and minimizes manual errors in invoicing.

What support is available for businesses adopting e-Invoicing?

The government offers the MyInvois Portal (a free invoicing tool), a mobile app, and tax incentives covering up to RM50,000 in implementation expenses from 2024 to 2027.

What happens if a business fails to comply with e-Invoicing requirements?

Non-compliance may result in penalties, fines, or tax audits, so businesses should ensure timely implementation to avoid legal and financial risks.