The business world is evolving, and so are the ways we manage financial transactions. Traditional invoicing methods—paper-based, manual, and time-consuming—are becoming obsolete. Enter cloud-based e-invoicing, a smarter, faster, and more secure way for Malaysian businesses to manage transactions.

With Malaysia’s push for digital transformation, e-invoicing is no longer just an option—it’s becoming a necessity. But what makes cloud-based invoicing superior to traditional methods? Let’s dive in.

Table of Contents

ToggleUnderstanding Cloud-Based E-Invoicing

Cloud-based e-invoicing is an electronic invoicing system hosted on a cloud platform. Unlike traditional invoicing, which relies on physical documents or locally stored digital files, cloud invoicing allows businesses to create, send, and track invoices in real time, from anywhere.

| Feature | Traditional Invoicing | Cloud-Based E-Invoicing |

|---|---|---|

| Storage | Paper files / Local PC | Cloud servers, accessible from anywhere |

| Automation | Manual entry | Automated workflows & integrations |

| Security | Risk of loss/damage | Encrypted & secure cloud storage |

| Cost | High printing & mailing costs | Reduced operational expenses |

| Compliance | Requires manual tracking | Automated tax & regulatory compliance |

The Legal Landscape in Malaysia

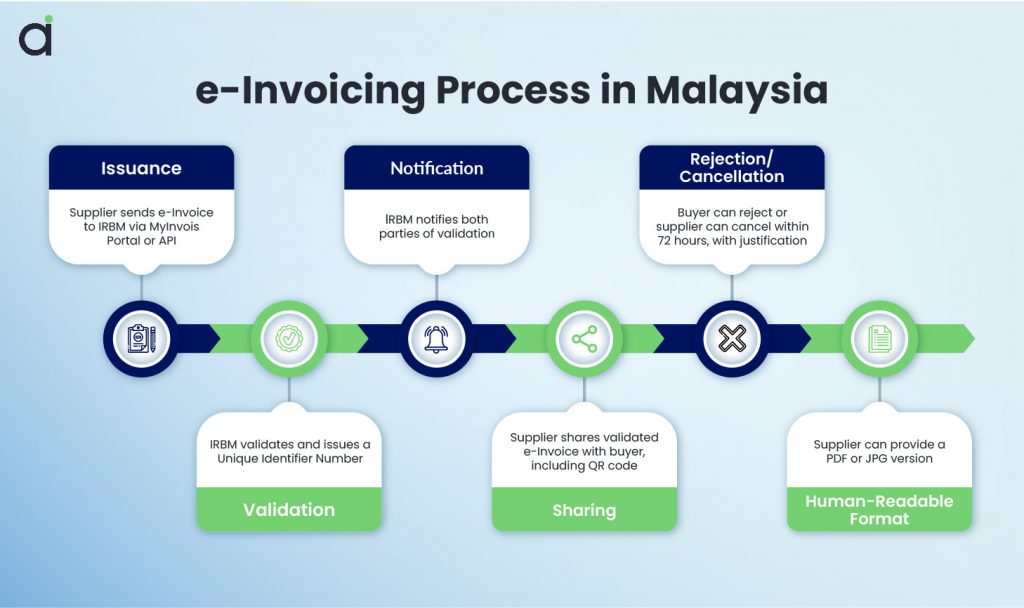

Malaysia is rapidly embracing digital invoicing, with the Lembaga Hasil Dalam Negeri (LHDN) introducing an e-invoicing framework to enhance tax compliance and financial transparency.

Key regulations include:

✅ Mandatory e-invoicing for large taxpayers starting 2024, expanding to SMEs by 2027

✅ Integration with LHDN’s MyInvois system for real-time tax reporting

✅ Adherence to Peppol standards, ensuring global compatibility

✅ Better Compliance – Many governments now require businesses to use e-invoicing to ensure tax compliance.

Businesses that fail to comply may face penalties, making it crucial to adopt an e-invoicing system that meets legal requirements.

Benefits of Cloud-Based E-Invoicing

Switching to a cloud-based e-invoicing system comes with multiple advantages:

🔹 Cost Savings & Efficiency – Reduces expenses related to printing, storage, and human errors.

🔹 Real-Time Access & Automation – Invoices are created, sent, and processed instantly, reducing delays.

🔹 Enhanced Security & Fraud Prevention – Encrypted cloud storage prevents data breaches and unauthorized access.

Common Challenges and How to Overcome Them

Despite its advantages, some businesses hesitate to adopt e-invoicing due to:

🚧 Resistance to Change – Employees may be reluctant to shift from familiar manual methods.

✅ Solution: Provide training and demonstrate time and cost savings.

🚧 Data Privacy Concerns – Storing financial data in the cloud raises security questions.

✅ Solution: Choose a provider with end-to-end encryption, multi-factor authentication, and compliance certifications.

🚧 Choosing the Right Platform – The abundance of options makes decision-making difficult.

✅ Solution: Prioritize ease of use, integration capabilities, and customer support.

Comparing Top E-Invoicing Solutions in Malaysia

📌 User-friendly Interface – Easy to navigate for all users

📌 Integration Capabilities – Works with existing accounting/ERP software

📌 Regulatory Compliance – Aligns with LHDN requirements

📌 Security Measures – Encryption, access control, and audit logs

| Platform | Best For | Key Features |

|---|---|---|

| Assist.biz | SMEs & Enterprises | LHDN compliance, automation, cloud storage |

| Xero | Small businesses | Simple invoicing & accounting |

| SAP Concur | Large enterprises | Advanced finance management & reporting |

The Future of E-Invoicing in Malaysia

Malaysia’s government aims to make digital transactions the norm, with e-invoicing playing a key role. In the coming years, we can expect:

📌 Mandatory e-invoicing adoption for all businesses

📌 AI-powered automation to reduce manual intervention

📌 Cross-border invoicing capabilities for global transactions

Businesses that transition early will gain a competitive advantage, ensuring compliance and efficiency.

Getting Started with Cloud-Based E-Invoicing

If you’re still relying on traditional invoicing, now is the time to switch. Here’s how:

1️⃣ Assess your business needs

2️⃣ Choose a cloud-based e-invoicing provider like Assist.biz

3️⃣ Train your team on the new system

4️⃣ Integrate with your accounting software

5️⃣ Ensure compliance with LHDN guidelines

🚀 Ready to future-proof your invoicing?

Join thousands of Malaysian businesses using Assist.biz for seamless, compliant, and automated cloud-based e-invoicing.

Frequently Asked Questions(FAQ)

What is cloud-based e-invoicing?

Cloud-based e-invoicing is an electronic invoicing system hosted on the cloud, allowing businesses to create, send, and track invoices in real time, improving efficiency and compliance.

Is e-invoicing mandatory in Malaysia?

Yes, Malaysia’s LHDN has mandated e-invoicing for large taxpayers starting in 2024, with a phased rollout for SMEs by 2027.

How does cloud-based e-invoicing benefit businesses?

It reduces costs, automates invoicing processes, enhances security, ensures compliance, and enables real-time access from anywhere.

What security measures are in place for cloud-based invoicing?

Most providers offer encryption, multi-factor authentication, and secure cloud storage to prevent unauthorized access.

Can e-invoicing integrate with existing accounting software?

Yes, leading e-invoicing solutions integrate seamlessly with accounting and ERP systems for a smoother financial workflow.

How do I choose the right e-invoicing provider in Malaysia?

Consider factors like compliance with LHDN regulations, ease of use, automation features, security, and integration capabilities.

How do I transition my business to cloud-based e-invoicing?

Assess your needs, select a provider like Assist.biz, train your team, integrate with your accounting system, and ensure regulatory compliance.