Get InvoiceNow-Ready in Under a Week Without changing your existing finance workflow!

Compliant with IMDA, works with your existing system, and saves up to 70%! Free trial available.

Available integration with:

How InvoiceNow Works

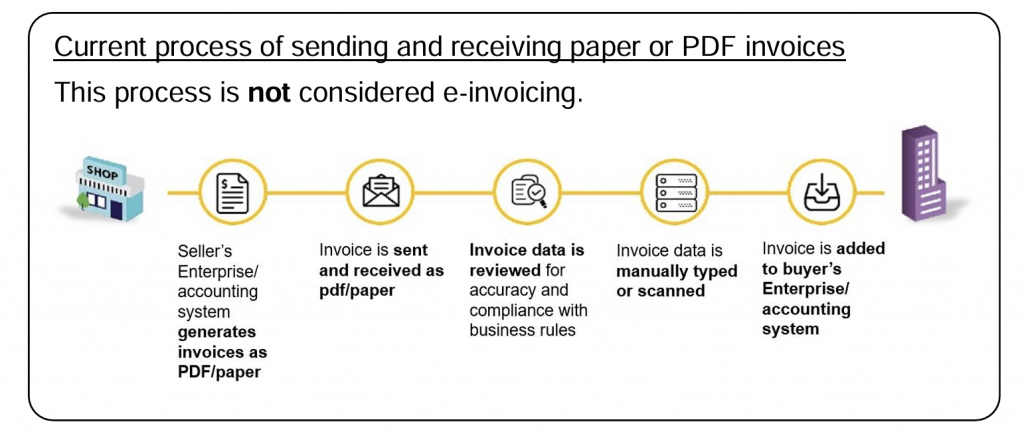

Before (Without InvoiceNow)

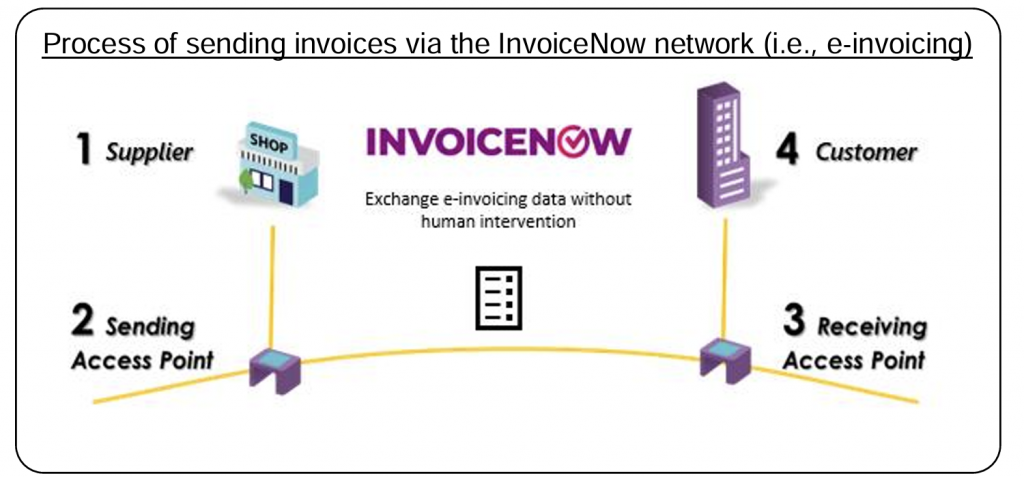

After (with InvoiceNow)

Simple Process To Use E-invoice With Assist.biz

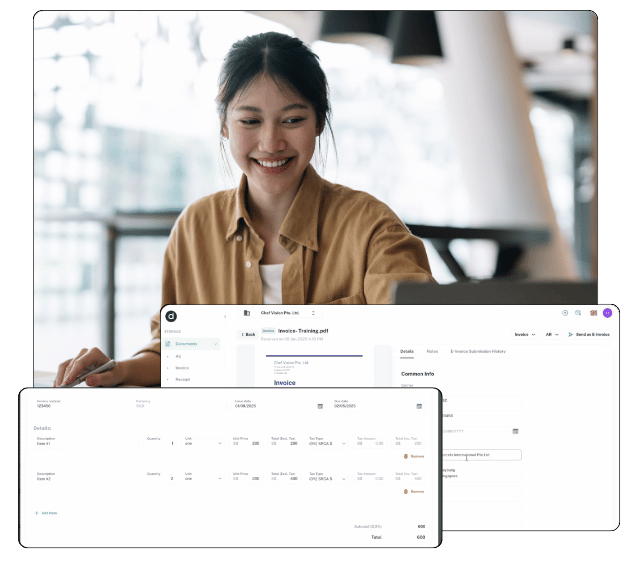

Upload/Email Your Documents

Our AI detects & extract your invoice, receipt, or claim

Review your document details

Send as E-invoice

Upload/Email Your Documents

Our AI detects & extract your invoice, receipt, or claim

Review your document details

Send your Invoice as E-invoice

No New Software Needed, No Workflow Changes!

No new software, no workflow disruptions. Keep your existing finance workflow with no costly or time-consuming changes.

E-Invoicing Compliance in Less Than a Week

Get E-Invoicing Ready in Under a Week! 🚀 Stay compliant quickly with a fast, hassle-free setup.

IMDA-compliant!

Effortlessly submit invoices, minimize errors, and ensure IMDA compliance.

Cloud-Based Solution to Digitize Your Invoices

Seamlessly works with both paper & digital invoices—no need to switch systems.

Advanced Duplicate Detection

Our system detect a duplicate invoices automatically, saving you from costly mistakes.

The Most Affordable E-Invoicing Solution with a Free Lifetime Trial!

Get a solution that’s 70% cheaper than competitors, with a free lifetime trial and no strings attached.

Smart OCR Your Fingertips

What our Customers say

Overall, my experience with ASSIST has been fantastic. My main suggestions are to enhance user guidance with more detailed tutorials or onboarding resources to make it easier for new users. Expanding language options and adding more customization features would also greatly improve the user experience.

ASSIST is a very reliable platform to help companies manage invoice/receipts/claims as it allow fuss free uploading of documents without manual typing on the system. Thus this helps companies to efficiently (by saving time) carry out their tasks with high accuracy.

ASSIST’s Optical Character Recognition is excellent! It not only handles invoices and receipts but also seamlessly supports bank statements, making document management easier and more efficient

Smart & Affordable Plans For Smarter Business

Experience our software for free, forever, with zero commitments!

Frequently Asked Questions About E-invoice

InvoiceNow allows direct transmission of invoices in a structured digital format from one finance system to another using the Nationwide E-delivery network, which is based on Peppol , creating opportunities for automation. As such, both SMEs and large enterprises can enjoy smoother invoicing and faster payments, with shorter invoicing processing time without any manual paperwork.

In a common business scenario today, an PDF e-invoice is sent to the recipient organisation by email. This is a single-sided operation requiring your recipient to re-enter the details of the invoice into their own accounting system (e.g. accounts payable). A more complete solution should include the transmission of data from supplier system to buyer system without human intervention and potentially allow for the InvoiceNow invoice to be paid seamlessly

Yes, InvoiceNow is a type of Electronic Data Interchange (EDI) based on the Peppol standards. Additionally, the Peppol network complements companies' existing EDI connections to allow einvoicing to businesses connected to the Peppol network.

Peppol is an international E-Document delivery network and business document standard

form of Electronic Data Interchange (EDI) allowing enterprises to digitally transact with other

linked companies on the Network.

No, InvoiceNow e-invoicing is based on the Peppol business document standard and operates over the Peppol network and allowing enterprises to digitally transact with other linked companies on the Network.

InvoiceNow is supported by ABS which is the Association of banks in Singapore, as both

InvoiceNow and PayNow are UEN based. Supporting banks are working on solutions that allow

users to flip InvoiceNow invoices to payment (such as PayNow) directly cutting down on

complexity and reducing business friction.

IMDA is the Peppol Authority responsible for definition of domestic rules, the governance of network by ensuring conformance of standards, and approving providers serving the

Singapore businesses.

No, InvoiceNow only covers business to business transactions. Business to consumer transactions are currently not covered.

You can activate InvoiceNow on any Peppol Ready solution which has been certified by IMDA. You can check the list of solution at https://www.imda.gov.sg/programme-listing/nationwidee-invoicing-framework/Peppol-Ready-Accounting-ERP-Solution-Providers

You should not replace your EDI solution if it is providing you benefits. Peppol network complements your existing EDI connections to allow e-invoicing to businesses connected to the Peppol network.