It wasn’t too long ago that businesses in Malaysia thrived on carbon copy invoices and WhatsApp receipts. But as digital transformation sweeps across industries, one thing has become abundantly clear—paper trails are becoming obsolete.

E-invoicing isn’t just a fancy buzzword anymore. It’s the new norm. For Malaysian businesses, it’s not a question of if, but when. So, where exactly are we in this shift? Is the SME sector embracing the change? Are solopreneurs catching up or getting left behind?

Let’s take a closer look.

Table of Contents

ToggleWhat Sparked the E-Invoicing Wave in Malaysia?

Malaysia’s push toward e-invoicing didn’t happen in a vacuum. In 2023, Lembaga Hasil Dalam Negeri (LHDN) announced the implementation of mandatory e-invoicing through the MyInvois portal starting in August 2024, with a staggered rollout based on business revenue.

But what lit the fire?

Global compliance pressures: Malaysia is aligning with global tax transparency movements.

The rise of digital businesses: From Shopee sellers to freelance graphic designers, everything is moving online.

Revenue leakages: E-invoicing allows LHDN to seal the gaps and improve tax collection.

In short, the nation needed a smarter, faster, and more transparent way of handling invoices—and e-invoicing was the answer.

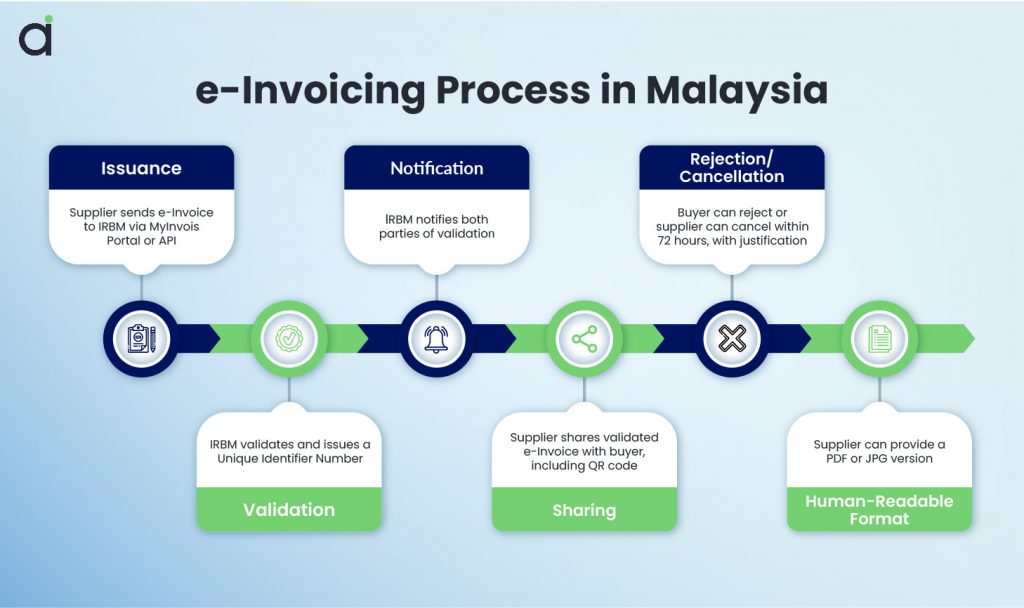

Understanding LHDN’s MyInvois and PEPPOL Framework

Two names dominate Malaysia’s e-invoicing framework: MyInvois and PEPPOL.

| Term | What It Means | Role in E-Invoicing |

|---|---|---|

| MyInvois | LHDN’s official e-invoicing platform | Where all B2B, B2G, and B2C invoices are verified |

| PEPPOL | Pan-European Public Procurement Online | Global standard for invoice exchange adopted by Malaysia |

Think of MyInvois as the gatekeeper. Before an invoice reaches your customer, it’s validated through this portal to ensure everything—from tax ID to amounts—is clean and compliant.

PEPPOL, on the other hand, is the bridge that connects different systems globally. It ensures that even if your client uses another platform, your invoice can still reach them seamlessly.

Current Adoption Rates: Are Malaysian Businesses Keeping Up?

A 2024 SME Corp Malaysia survey revealed that only 27% of small and medium enterprises (SMEs) had begun their e-invoicing journey. Among solopreneurs, the figure was even lower at 12%.

Here’s a quick snapshot:

| Business Type | Adoption Rate (2024) | Projected by 2026 |

|---|---|---|

| Large Corporations | 78% | 100% |

| SMEs | 27% | 70% |

| Solopreneurs | 12% | 50% |

While big businesses are marching ahead, many smaller outfits are still evaluating their options—or worse, unaware of the deadlines altogether.

Challenges Faced by Businesses in E-Invoicing Transition

Switching from manual to digital invoicing isn’t just a software change. It’s a cultural shift.

Here’s what’s holding some folks back:

- Lack of technical know-how – Many business owners fear the learning curve.

- Perceived cost – They assume e-invoicing solutions are expensive.

- Fear of disruption – “What if the system breaks down mid-sale?”

- Unclear guidelines – Despite efforts, some still find LHDN’s instructions confusing.

One solopreneur we spoke to, who runs a home bakery in Penang, said,

“I just want to bake cakes, not deal with digital tax!”

This anxiety is real—and valid. But it’s also manageable with the right support.

Common Misconceptions About E-Invoicing in Malaysia

Let’s bust a few myths:

| Misconception | Reality |

|---|---|

| “It’s only for big companies.” | False. Even sole proprietors must comply based on revenue thresholds. |

| “It’s expensive.” | Plenty of affordable or even free solutions exist. |

| “I’ll lose control over my invoices.” | You actually gain visibility and traceability. |

| “I can wait until the last minute.” | The earlier you start, the easier the transition. |

The truth? E-invoicing levels the playing field—if you get on board early.

The Road Ahead: What to Expect in the Coming Months

Here’s LHDN’s current e-invoicing implementation timeline:

Aug 2024 – Companies with revenue above RM100 million

Jan 2025 – Revenue above RM25 million

July 2025 – Revenue above RM1 million

2026 onwards – Gradual expansion to all businesses

Expect more integrations with POS systems, mobile invoicing apps, and accounting software. The ecosystem is evolving fast—and those who delay will face unnecessary bottlenecks.

Practical Tips to Embrace E-Invoicing Without the Stress

Let’s keep it simple. Here’s how to make the switch smoother:

✅ Audit your current invoicing process – Where are the pain points?

✅ Choose a PEPPOL-ready solution – It saves future headaches.

✅ Train your team early – Even if it’s just you and a VA.

✅ Sync with LHDN guidelines – Bookmark the MyInvois site.

✅ Start small – Try sending e-invoices to one client before rolling out fully.

Adopting e-invoicing is not a sprint. It’s a gradual pivot that pays off with speed, accuracy, and peace of mind.

Conclusion

The truth is clear—e-invoicing is here to stay. The question is, will you ride the wave or risk being swept under?

If the idea of figuring out LHDN’s formats, integrating PEPPOL, and managing compliance sounds overwhelming, you’re not alone. That’s where Assist.biz steps in.

Whether you’re a solopreneur running a one-man show or an SME looking to scale, Assist.biz helps you issue compliant e-invoices seamlessly, with zero jargon and full support.

✅ PEPPOL-integrated

✅ MyInvois-ready

✅ Easy for non-tech users

✅ Transparent pricing

Join hundreds of Malaysian businesses already simplifying their invoicing with Assist.biz.

Don’t wait until deadlines turn into penalties.

FAQs: E-Invoicing Adoption in Malaysia

What is e-invoicing and why is it important in Malaysia?

E-invoicing is the digital generation, validation, and exchange of invoices between businesses and tax authorities. In Malaysia, it’s becoming mandatory as part of LHDN’s efforts to increase tax transparency, streamline processes, and reduce fraud.

When will e-invoicing be mandatory in Malaysia?

The e-invoicing rollout in Malaysia starts in August 2024 for companies with annual revenue above RM100 million. By 2025, it will extend to businesses with lower revenue, and eventually, all businesses will be required to comply.

How is e-invoicing adoption in Malaysia progressing so far?

As of early 2025, e-invoicing adoption in Malaysia is gaining traction among large corporations, while SMEs and solopreneurs are slowly catching up. Awareness is growing, but technical challenges and lack of clarity still hinder faster adoption.

Do small businesses and freelancers need to use e-invoicing too?

Yes, even solopreneurs and small businesses will need to comply based on their revenue brackets. Over time, all business entities—regardless of size—will be required to adopt e-invoicing in Malaysia.

What platform is used for e-invoicing in Malaysia?

Malaysia uses the MyInvois portal, managed by LHDN, for invoice validation. It works alongside the PEPPOL network to ensure invoices can be exchanged globally and securely.

What are the benefits of e-invoicing for Malaysian businesses?

E-invoicing helps reduce paperwork, speeds up payment cycles, minimizes errors, enhances audit readiness, and ensures full compliance with tax regulations. It also improves business credibility and trust.

What happens if my business doesn’t adopt e-invoicing in time?

Non-compliance may lead to penalties, delays in tax submissions, and interrupted business operations. Preparing early ensures a smooth transition and avoids last-minute chaos.