The world of finance is evolving rapidly, and for startups, keeping up with digital advancements is crucial. One of the most transformative changes in recent years is the shift toward e-invoicing. Traditional invoicing methods—paper-based or even PDF invoices—are slow, prone to errors, and can create financial bottlenecks. For startups, where cash flow and efficiency are paramount, e-invoicing is more than just a convenience; it’s a necessity.

Table of Contents

ToggleUnderstanding E-Invoicing: A Quick Overview

E-invoicing refers to the electronic generation, transmission, and processing of invoices in a structured digital format. Unlike traditional PDFs or paper invoices, e-invoices can be directly read and processed by accounting software, reducing manual effort and errors.

How E-Invoicing Differs from Traditional Methods

| Feature | Traditional Invoicing | E-Invoicing |

|---|---|---|

| Format | Paper/PDF | Digital & Structured |

| Processing Speed | Slow | Instant |

| Compliance | Requires manual tax calculations | Automated tax compliance |

| Security | Prone to fraud and loss | Secure & encrypted |

| Cost | Printing & storage expenses | Reduced costs |

Why E-Invoicing is a Must for Startups

Startups operate in a fast-paced environment where efficiency can make or break success. Here’s why adopting e-invoicing is a strategic move:

Cost Savings – Eliminates paper, printing, and storage expenses.

Faster Payments – Automated invoicing reduces delays and improves cash flow.

Regulatory Compliance – Aligns with Malaysia’s growing digital tax ecosystem.

Operational Efficiency – Reduces human errors and manual processing time.

Key Features to Look for in an E-Invoicing Solution

Choosing the right e-invoicing system is crucial. Here are the must-have features:

Automated Tax Calculations – Ensures compliance with LHDN regulations.

Seamless Integration – Connects with accounting software like Xero or QuickBooks.

Custom Branding – Enables professional-looking invoices with your company’s identity.

Real-Time Tracking – Allows startups to monitor invoice status instantly.

Secure Data Storage – Protects financial data from fraud and breaches.

The Legal Landscape: E-Invoicing Compliance in Malaysia

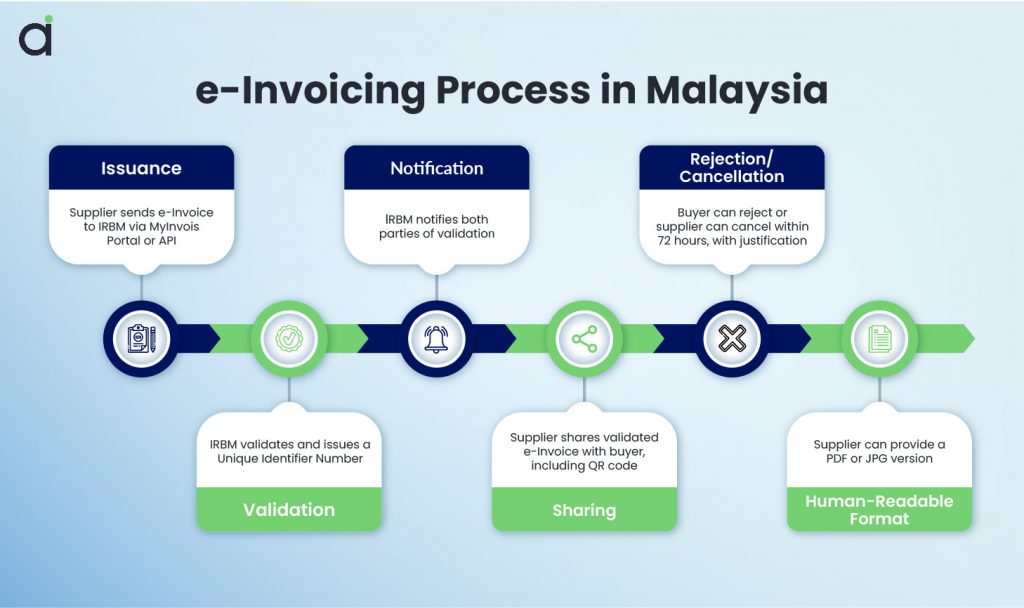

Malaysia is transitioning towards mandatory e-invoicing under the MyInvois system. Startups need to stay informed to avoid penalties.

What You Need to Know About Compliance

LHDN Regulations – Adherence to structured invoice formats and digital submissions.

MyInvois System – Malaysia’s centralized e-invoicing platform for streamlined tax reporting.

Common Pitfalls – Errors in invoice formatting, missing details, and incorrect tax calculations can lead to compliance issues.

Common Challenges & How to Overcome Them

1. Transitioning from Manual Invoicing

Solution: Gradual adoption through hybrid invoicing before full implementation.

2. Customer & Vendor Adoption

Solution: Educate partners on e-invoicing benefits and provide user-friendly guides.

3. Security Concerns

Solution: Choose a platform with strong encryption and compliance certifications.

How to Get Started with E-Invoicing in Malaysia

- Assess Your Needs – Identify your invoicing volume and integration requirements.

- Choose the Right Platform – Opt for an LHDN-approved e-invoicing solution like Assist.biz.

- Register for MyInvois – Ensure compliance with Malaysia’s regulatory framework.

- Onboard Your Team – Train employees on system usage.

- Go Live – Implement and refine processes for maximum efficiency.

The Future of E-Invoicing for Startups

E-invoicing is not just a trend; it’s the future. Advancements in AI and automation will further streamline financial management, reducing errors and improving overall business efficiency. Future developments may include blockchain-based invoicing, real-time tax reporting, and fully automated financial ecosystems.

Conclusion

E-invoicing is a game-changer for startups in Malaysia. It offers faster payments, cost efficiency, and ensures compliance with tax regulations. Adopting it early gives startups a competitive edge in financial management.

Want to simplify your invoicing and ensure compliance? Sign up with Assist.biz today and transform your startup’s financial operations.

Frequently Asked Questions (FAQ)

Is e-invoicing mandatory for startups in Malaysia?

Not yet, but Malaysia is gradually moving towards mandatory e-invoicing under the MyInvois system. Staying ahead by adopting it early ensures smooth compliance when it becomes a requirement.

How does e-invoicing improve cash flow?

E-invoicing reduces processing delays, speeds up invoice approvals, and enables faster payments by automating reminders and follow-ups.

Can I integrate e-invoicing with my existing accounting software?

Yes, many e-invoicing platforms support integration with accounting tools like Xero, QuickBooks, and local ERP solutions.

Are e-invoices secure?

Yes, e-invoicing solutions use encryption and secure data storage to protect sensitive financial information from fraud and cyber threats.

How can I encourage my clients to accept e-invoices?

Educate them on the benefits, provide easy-to-use digital payment options, and offer incentives for early adoption.

What costs are associated with implementing e-invoicing?

While some platforms charge subscription fees, e-invoicing reduces long-term costs related to paper, storage, and manual processing.