The adoption of Peppol framework has accelerated the rise of e-invoicing adoption in Malaysia. However, businesses must understand that Malaysia’s mandatory e-invoicing implementation in 2025 is based on the MyInvois system developed by the Inland Revenue Board of Malaysia (LHDN), not Peppol. This article explores the nature of Peppol e-invoicing, its advantages, and its relevance for Malaysian businesses, particularly for cross-border transactions.

Table of Contents

ToggleWhat Is Peppol E-Invoicing?

The international network Peppol (Pan-European Public Procurement On-Line) enables standardized electronic document exchange including invoices between businesses on an international level. Peppol started as an European market solution but Malaysian government and other countries have embraced it to facilitate international trade and procurement.

Businesses can securely exchange e-invoices through Peppol network using certified Access Points (APs). The standardized method reduces inconsistencies while improving system connectivity and shortens invoice handling duration.

How Malaysia’s E-Invoicing System Works

Malaysia’s e-invoicing framework is not solely based on Peppol. Instead, the MyInvois system, managed by LHDN, is the official platform for mandatory e-invoicing compliance. Businesses will be required to integrate their invoicing systems with MyInvois, either via API connections or through the LHDN e-invoicing portal.

Peppol e-invoicing is optional for businesses that want to enhance international invoicing capabilities and improve interoperability with foreign companies.

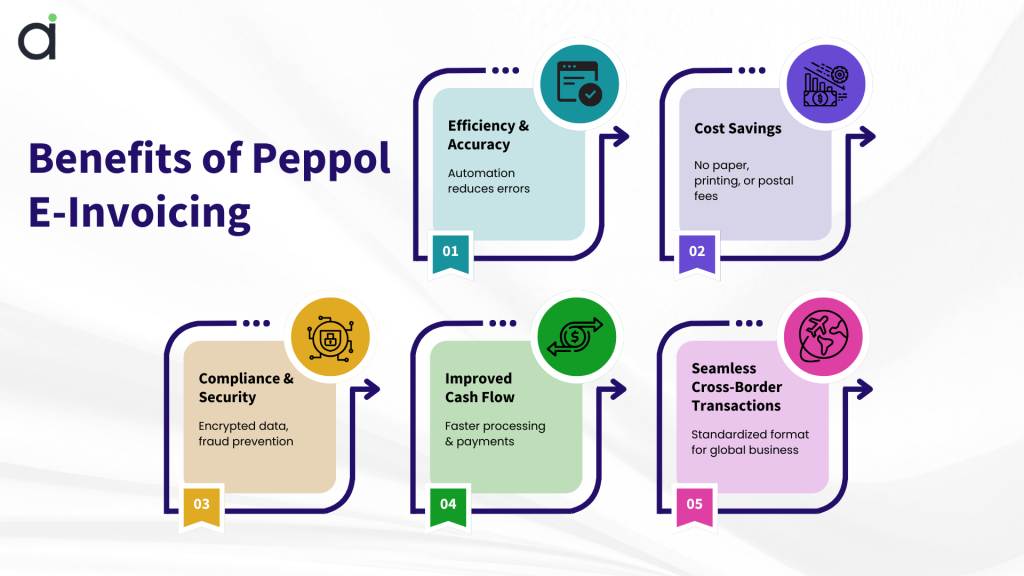

Benefits of Peppol E-Invoicing

1. Enhanced Efficiency and Accuracy

Errors can arise from manual invoicing processes. The automated Peppol system reduces mistakes and makes for faster processing, assuring increased data accuracy.

2. Cost Savings

Peppol e-invoicing helps companies cut the cost of doing business-with fewer paper invoices to print and distribute, consequently lowering printing and postal costs.

3. Compliance and Security

Although not a requirement for local compliances, Peppol adheres to global e-invoicing norms. E-document exchange reduces the risk of invoice fraud and unauthorized changes.

4. Improved Cash Flow Management

Reduced time for invoice processing allows for quicker payments through Peppol, improving the financial health of its users.

5. Seamless Cross-Border Transactions

Standardized invoicing afforded by Peppol enables businesses that trade internationally to conduct transactions across multiple countries much more efficiently.

How to Implement Peppol E-Invoicing in Malaysia

Step 1: Assess Readiness

Organizations must examine their present invoicing operations to assess their capability for implementing Peppol e-invoicing. A business must first comprehend all compliance regulations while identifying any required system improvements.

Step 2: Choose a Peppol Access Point Provider

Organizations intending to avail of Peppol must connect through a certified Peppol Access Point provider, which complies with international standards.

Step 3: Integrate E-Invoicing with Accounting Software

Some accounting software supports the integration of Peppol. Such organizations must consult their software vendors for smooth integration.

Step 4: Train Staff and Test the System

Adequate training allows the staff to understand the e-invoicing process. Testing transactions ought to discover any potential problems and resolve them before going live.

Step 5: Go Live and Monitor Compliance

Following implementation, organizations must monitor the performance of the system in a live mode to ensure they remain in compliance at all times with Malaysian regulations (MyInvois) and the Peppol standards.

Common Challenges in Peppol E-Invoicing Implementation

1. System Integration Issues

The implementation of Peppol e-invoicing systems poses difficulties when merging with current accounting software platforms. Organizations should partner with IT experts and software providers to resolve compatibility problems.

2. Change Management

The adoption of Peppol e-invoicing demands organizations to modify their current operational procedures. The resistance of employees to change creates obstacles for the adoption process. The implementation of proper training and change management strategies assists in reducing this challenge.

3. Compliance Requirements

Tracing the difference between MyInvois compliance (mandatory) and Peppol adoption (optional for international transactions) is crucial for businesses. It is really important to keep updated with the changing regulations.

Conclusion

Peppol e-invoicing gives several advantages for global trading companies. However, in Malaysia, it is not made compulsory. Businesses must first ensure compliance with the local e-invoicing requirement under LHDN’s MyInvois system. Those with ambitions to improve cross-border invoice efficiency may want to complement their compliance strategy by adopting Peppol. Knowing the differences between MyInvois and Peppol, businesses will be in a better position to make decisions and improve their invoicing process as the digital landscape continues to evolve.

📊 Revolutionize Your Invoicing with Assist E-Invoice Software!

Struggling with tax compliance, invoicing delays, and manual mistakes? Assist E-Invoice Software takes the hassle out of invoicing—so you can save time, reduce errors, and stay fully compliant.

🚀 Why Assist?

✅ Smart Automation – No more paperwork or manual entry.

✅ Instant Tax Compliance – Stay updated with the latest regulations.

✅ Faster Payments – Get paid on time, every time.

✅ Affordable & Cost-Effective – Get premium features without breaking the bank

📅 Say goodbye to invoicing stress—switch to a smarter solution today!

Frequently Asked Questions (FAQ)

Is Peppol e-invoicing mandatory in Malaysia?

No, Peppol e-invoicing is not mandatory in Malaysia. The official mandatory e-invoicing system, MyInvois, is developed by LHDN. Peppol is an optional system that businesses can use for cross-border transactions.

Do Malaysian businesses need to register for Peppol?

No, Malaysian businesses do not need to register for Peppol unless they want to use it for international invoicing. To comply with Malaysia’s e-invoicing regulations, businesses must integrate with MyInvois.

Can Peppol be used alongside MyInvois?

Yes, businesses can use Peppol in addition to MyInvois if they engage in cross-border transactions. However, for local compliance, businesses must adhere to MyInvois requirements.

How do businesses connect to the Peppol network?

Businesses need to select a certified Peppol Access Point (AP) provider to establish a secure connection to the Peppol network.

What are the benefits of Peppol for international trade?

Peppol facilitates standardized e-invoicing, making it easier for businesses to trade with partners in multiple countries by reducing administrative complexity and improving invoice processing times.